Editor’s note: The headline and body of this story have been corrected to specify the price action was in Nikkei 225 futures.

The Bank of Japan (BoJ) intervened in the foreign-exchange market on Monday to bolster the weakening Japanese yen, which had plunged to a 34-year low of 160 per dollar.

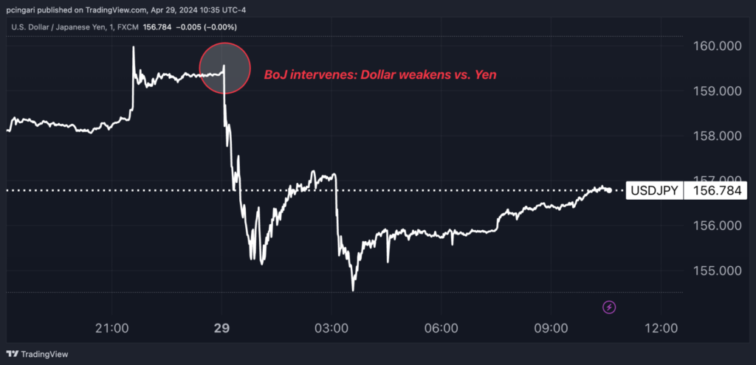

In response to the move, the yen saw a notable recovery, jumping as much as 3% to 154.6 against the dollar following the intervention, before retracing to 156.80 at the time of this writing.

Chart: Dollar-Yen Tumbles After BoJ Intervenes In FX Market

Why Did The BoJ Intervene?

In response to the Japanese yen depreciating by over 10% in less than four months in 2024, Japanese monetary authorities decided on Monday to take actions to stabilize the domestic currency’s value.

These interventions are typically ordered by the Ministry of Finance, as officials believe that sudden and disorderly fluctuations in exchange rates can have adverse financial consequences.

The yen had experienced depreciation in six of the previous seven weeks, reaching as low as 160 against the dollar, prompting the Bank of Japan to deploy countermeasures.

Foreign exchange interventions involve the sale of foreign exchange reserves in exchange …

Full story available on Benzinga.com

Editor’s note: The headline and body of this story have been corrected to specify the price action was in Nikkei 225 futures.

The Bank of Japan (BoJ) intervened in the foreign-exchange market on Monday to bolster the weakening Japanese yen, which had plunged to a 34-year low of 160 per dollar.

In response to the move, the yen saw a notable recovery, jumping as much as 3% to 154.6 against the dollar following the intervention, before retracing to 156.80 at the time of this writing.

Chart: Dollar-Yen Tumbles After BoJ Intervenes In FX Market

Why Did The BoJ Intervene?

In response to the Japanese yen depreciating by over 10% in less than four months in 2024, Japanese monetary authorities decided on Monday to take actions to stabilize the domestic currency’s value.

These interventions are typically ordered by the Ministry of Finance, as officials believe that sudden and disorderly fluctuations in exchange rates can have adverse financial consequences.

The yen had experienced depreciation in six of the previous seven weeks, reaching as low as 160 against the dollar, prompting the Bank of Japan to deploy countermeasures.

Foreign exchange interventions involve the sale of foreign exchange reserves in exchange …

Full story available on Benzinga.com

Editor’s note: The headline and body of this story have been corrected to specify the price action was in Nikkei 225 futures.

The Bank of Japan (BoJ) intervened in the foreign-exchange market on Monday to bolster the weakening Japanese yen, which had plunged to a 34-year low of 160 per dollar.

In response to the move, the yen saw a notable recovery, jumping as much as 3% to 154.6 against the dollar following the intervention, before retracing to 156.80 at the time of this writing.

Chart: Dollar-Yen Tumbles After BoJ Intervenes In FX Market

Why Did The BoJ Intervene?

In response to the Japanese yen depreciating by over 10% in less than four months in 2024, Japanese monetary authorities decided on Monday to take actions to stabilize the domestic currency’s value.

These interventions are typically ordered by the Ministry of Finance, as officials believe that sudden and disorderly fluctuations in exchange rates can have adverse financial consequences.

The yen had experienced depreciation in six of the previous seven weeks, reaching as low as 160 against the dollar, prompting the Bank of Japan to deploy countermeasures.

Foreign exchange interventions involve the sale of foreign exchange reserves in exchange …Full story available on Benzinga.com Read Moreapan, Asia, EWJ, Expert Ideas, fx interventions, Interest Rates, Japan, Macro Economic Events, Macro Notification, Stories That Matter, TM, yen, Bonds, Specialty ETFs, Forex, Treasuries, Top Stories, Economics, Federal Reserve, ETFs, EWJ, US4642868487, TM, US8923313071, Asia, Macro Economic Events, Macro Notification, Bonds, Specialty ETFs, Forex, Treasuries, Top Stories, Economics, Federal Reserve, ETFs, Benzinga Macro Economic Events