Bearish Abandoned Baby Candlestick Pattern: Technical analysts utilize multiple methods to predict the future movement of the price of a stock. Technical analysis is derived from the historical price reaction and uses that to predict future price reactions.

One method in technical analysis is candlestick patterns and in this article, we will discuss one of the rarely forming candlestick patterns called the Bearish Abandoned Baby candlestick Pattern.

Bearish Abandoned Baby Candlestick Pattern – Definition

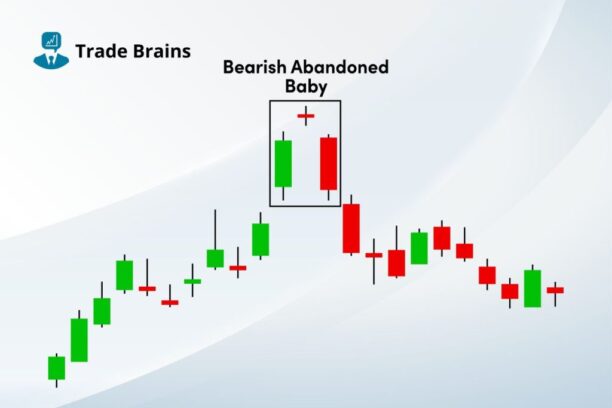

The Bearish Abandoned Baby candlestick pattern, consisting of three candles, indicates a negative shift in the market mood. Similar to the evening doji star pattern, this formation is most effective after an uptrend, improving the chances of a successful bearish reversal.

The Bearish Abandoned Baby pattern is a rare yet strong candlestick pattern that signals a bearish reversal in the market. This pattern has similar candlestick constituents to the Evening Doji star pattern. However, the low of the doji candle in this pattern is completely separated from the other two candles, hence suggesting an abandoned baby.

Bearish Abandoned Baby Candlestick Pattern – Formation

A few conditions need to be fulfilled for a three-candlestick pattern to be called a Bearish Abandoned Baby candlestick pattern and they are as follows:

The first candle must be a long-bodied bullish candle along the uptrend.

The second candle should form a doji, characterized by its small body, opening above the high of the preceding candle. Additionally, this doji candle’s low should not touch the previous candle’s high.

The third candle should be a long bearish candlestick that begins below the low of the previous doji candle. Furthermore, the peak should be lower than the low of the previous candle.

Bearish Abandoned Baby Candlestick Pattern – Meaning

The Bearish Abandoned Baby candlestick pattern frequently denotes a shift in market sentiment and may indicate the conclusion of an upswing. Initially, a green candle signals that prices will continue to rise due to increasing purchasing activity. Following that, a detached doji candle appears, representing a momentary equilibrium of buying and selling pressures and implying a weakening trend.

Finally, a red candle forms, with its high failing to exceed the low of the previous candle, showing that selling pressure has overtaken purchasing pressure, implying a shift in market mood. Based on the formation of this pattern and confirmation from other indicators, traders can choose to take a short position.

Also read…

Bearish Abandoned Baby Candlestick Pattern – Trading Ideas

Traders who wish to trade based on this pattern should ensure that the trend before its formation needs to be an uptrend. Once that is confirmed, the following are the guidelines for taking a trade:

ENTRY: Traders may consider taking a short position when the stock price begins to trade below the closing price of the third candle in the Bearish Abandoned Baby pattern.

TARGET: Traders have the option to exit the trade as the stock price approaches the nearest support level. Upon reaching this level, they may choose to book partial profits and retain the remaining position until the subsequent support level.

STOP LOSS: Traders can place the stop loss near the high price of the evening doji star candlestick pattern.

Bearish Abandoned Baby Candlestick Pattern – Example 1

In the above one day chart of HDFC BANK, we can observe that the bearish abandoned baby candlestick pattern was formed after a small uptrend. As discussed above, the price of the stock saw a bearish movement after the formation of this pattern.

At the time of the formation of this pattern, traders could have a taken a short position at Rs.922.75 and the stop loss was at Rs. 1019.2

Bearish Abandoned Baby Candlestick Pattern – Example 2

In the above one-day chart of MMTC, we can observe that the bearish abandoned baby candlestick pattern was formed after a small uptrend. As discussed above, the price of the stock saw a bearish movement after the formation of this pattern.

At the time of the formation of this pattern, traders could have a taken a short position at Rs.78.2 and the stop loss was at Rs.89.15

Difference between Bearish Abandoned Baby and Evening Doji Star Candlestick Pattern

The Evening Doji Star forms with three candles: a large bullish candle, followed by a doji candle, and finally a large bearish candle. Here, the high of the doji candle will be within the range of the other two candles in the pattern.

While the bearish abandoned baby shares similar features to that of an Evening doji star pattern, the low of the doji candle in this pattern is completely separated from the lows of the other two candles.

While both patterns suggest a bearish reversal, the bearish abandoned baby pattern has a higher probability of success than the evening doji star pattern.

Bearish Abandoned Baby Candlestick Pattern – Key Features

The Bearish Abandoned Baby candlestick pattern is characterized by several key features:

Initial Green Candle: The pattern begins with a long bullish candle, indicating an ongoing uptrend in the market.

Doji Candle: Following the initial green candle, a doji candle appears, which signifies indecision in the market and suggests a potential weakening of the uptrend. This candle is also separated from the other two candles of the pattern.

Gap Down: The doji candle is followed by a third bearish candle that opens significantly lower than the close of the previous candle, creating a gap between the two candles.

High of Third Candle: The high of the third candle does not surpass the low of the doji candle, indicating a shift in sentiment from bullish to bearish as selling pressure increases.

Volume Confirmation: Ideally, there should be an increase in trading volume during the formation of the pattern, confirming the potential reversal in trend.

Indication: The indication given by this pattern is bearish reversal and the probability of succeeding increases if this forms after an uptrend.

Read more: Fundamental Analysis Of Grindwell Norton

Conclusion

In this article we understood in detail about one of the rarely forming candlestick patterns called the Bearish Abandoned Baby candlestick pattern. We discussed how this pattern is formed, how to identify it, the underlying reason for the formation, and how to take a trade based on that.

It is also important to understand that no technical analysis is 100% accurate and hence the traders must always place appropriate stop loss in place so that they can reduce the loss in situations where the trade goes against the analysis.

Written by Praneeth Kadagi

By utilizing the stock screener, stock heatmap, portfolio backtesting, and stock compare tool on the Trade Brains portal, investors gain access to comprehensive tools that enable them to identify the best stocks, also get updated with stock market news, and make well-informed investments.

The post Bearish Abandoned Baby Candlestick Pattern – Features And More appeared first on Trade Brains.

Bearish Abandoned Baby Candlestick Pattern: Technical analysts utilize multiple methods to predict the future movement of the price of a stock. Technical analysis is derived from the historical price reaction and uses that to predict future price reactions. One method in technical analysis is candlestick patterns and in this article, we will discuss one of

The post Bearish Abandoned Baby Candlestick Pattern – Features And More appeared first on Trade Brains. Read MoreTechnical Analysis, Trading, All candlestick patterns, Are candlestick patterns effective?, bearish abandoned baby candlestick pattern, Candlestick Patterns, most rarest candlestick, stock market, What does abandoned baby mean?, What is a bearish abandoned baby?, What is the abandoned baby formation?, What is the abandoned baby pattern in stocks?, What is the difference between bearish abandoned baby and bullish abandoned baby?, What is the rarest candlestick pattern? Trade Brains