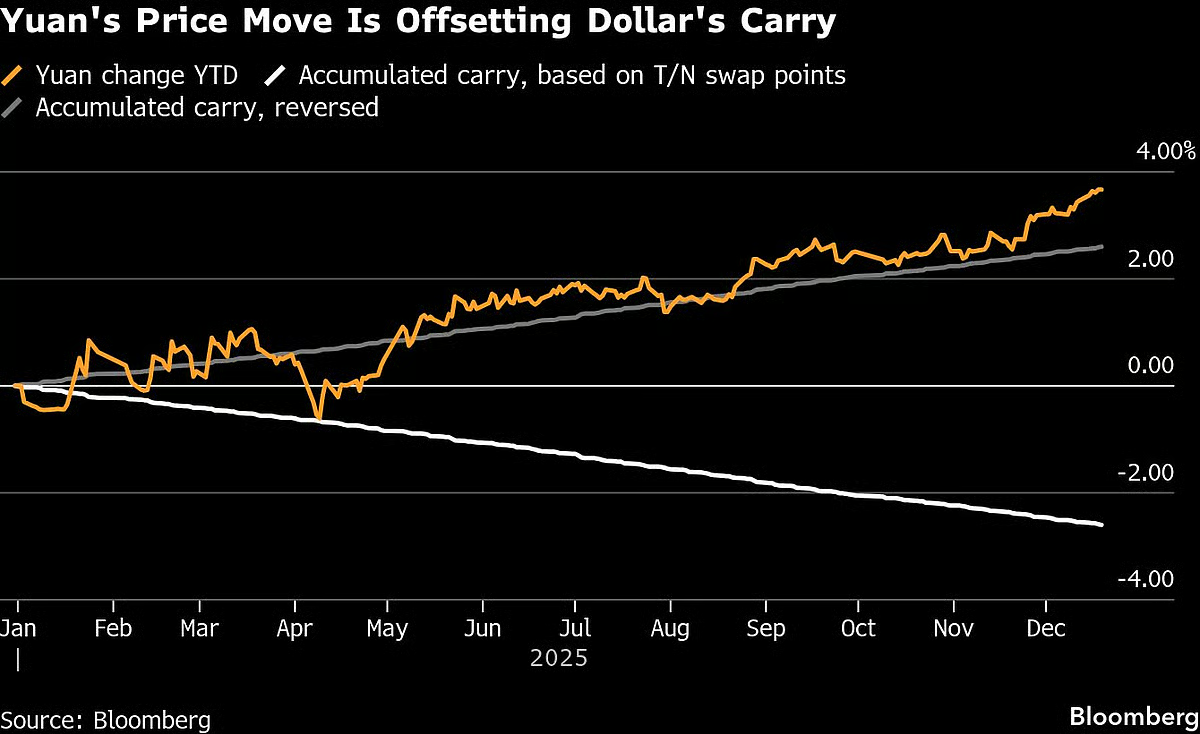

China maintained a tight grip on the yuan with its daily reference rate, as an overnight rally in the dollar threatened to derail sentiment toward the managed currency and its Asian peers.

The People’s Bank of China set the so-called fixing 1,528 pips stronger than the average estimate in a Bloomberg survey of traders and analysts on Wednesday. That was the widest gap since April, indicating policymakers’ intention to avoid sharp yuan declines.

The move came as an advance in the dollar, a result of surging treasury yields and resilient US economic data prompted the offshore yuan to resume its climb toward a two-year low touched last month. Most Asian currencies including Thai baht and Philippine peso also retreated.

“The PBOC appears determined to support the yuan,” said Alvin T. Tan, head of Asia FX strategy at RBC Capital Markets. The central bank is aiding the currency “not just with the onshore daily fixes, but also through the extremely high offshore funding rates.”

For months, China has been trying to strike a balance between easing monetary policy to aid growth and supporting the yuan to avoid massive capital outflows. However, a yawning interest-rate discount to the US, looming tariff-hike threats and a sluggish economic recovery locally are putting pressure on the currency despite the PBOC’s support.

Other Tools

The central bank has been using the fixing, which limits moves in the onshore yuan to 2% on either side, to stem currency losses. A surge in yuan’s borrowing cost in Hong Kong this week also reflects expectations among traders that the PBOC may enlist other tools like squeezing offshore liquidity to damp bearish bets.

State-owned banks continued to cut their offshore yuan liquidity provision in short-end tenors of the swap market, exacerbating the liquidity squeeze, according to traders. In the onshore market, state banks sold dollar-yuan at levels close to 7.3320, said the traders who are not allowed to speak publicly.

In a clear sign of official concerns, the central bank vowed in a readout of its latest quarterly monetary policy meeting to crack down on behavior that disrupts the market and prevent the building of one-sided bets as well as any overshoot in the exchange rate. Local media outlet Yicai reported on Monday that the PBOC was planning to increase bill auctions in Hong Kong.

“We continue to see upside risk for dollar-yuan and it is a matter of time before PBOC would be compelled to shift the dollar-yuan fixings higher,” said Wee Khoon Chong, senior APAC market strategist at BNY.

The yuan edged lower versus the greenback in both onshore and offshore markets on Wednesday, in a sign that traders continue to remain bearish on the currency. The onshore has been approaching the weak end of its permitted trading range this month. It deviated as much as 1.992% from the Wednesday’s fixing, the closest it’s been to the price limit on the weak end.

“When spot is near the extreme weak side of the daily band, fear of yuan depreciation leads to hoarding of FX and an increased supply of FX to the market from state banks/official sector,” Nomura strategists including Craig Chan wrote in a note.

“Although some of the tariff risk might be in the price, we still believe this will lead to a break higher in dollar-offshore yuan” if Donald Trump on his inauguration day on January 20 imposes an additional 10% tariffs on China, they wrote.

. Read more on Markets by NDTV Profit.Most Asian currencies including Thai baht and Philippine peso also retreated. Read MoreMarkets, Economy & Finance, World, Bloomberg

NDTV Profit