As India prepares for the upcoming Budget 2025, HSBC forecasts that the government will achieve its fiscal deficit target of 4.8% of GDP in FY25, slightly better than the initial budgeted figure of 4.9%. This positive outcome is mainly attributed to a slowdown in capital expenditure (capex), partly due to delays in project approvals amid the election year. However, looking ahead to FY26, the fiscal consolidation path will be much more difficult, as the government seeks to lower the deficit to below 4.5% of GDP.

The brokerage expects complex financial landscape that the government will navigate in FY26. With a softening economy, slower-than-expected revenue growth, and ongoing challenges in balancing fiscal consolidation with essential public spending, the February 1 budget will be pivotal for setting the course for India’s fiscal health in the coming years.

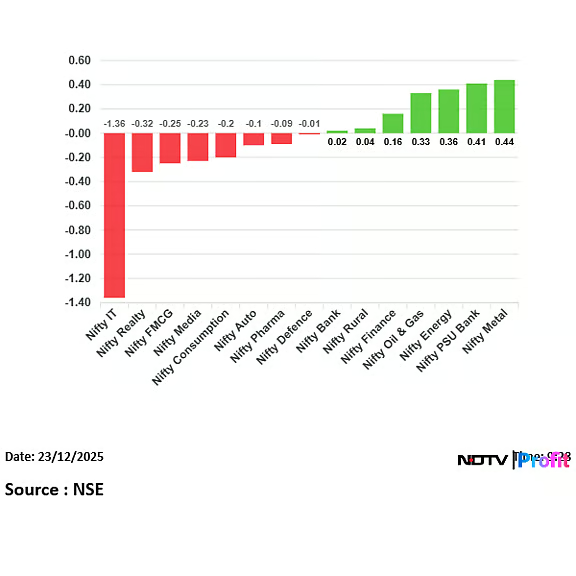

Revenue growth from taxes is expected to remain steady, but other sources of income, such as disinvestment receipts and capital gains taxes, are showing signs of weakness. The equity market slowdown, for instance, has dampened the capital gains tax receipts, and this is expected to continue into FY26. The forecasted revenue buoyancy of 1% could further constrain the government’s ability to boost spending while meeting fiscal targets.

The real hurdle for the government will be managing current expenditure, which is likely to exceed budgeted targets due to rising subsidy costs, particularly in fertilisers and food. In an environment of muted growth and political sensitivity around subsidy cuts, reducing these costs will be a delicate task. To meet the fiscal deficit reduction goal, HSBC anticipates that the government will need to trim non-subsidy, non-interest expenditure by 0.3% of GDP—an ambitious target given the increasing number of centrally sponsored schemes.

At the same time, the outlook for capex in FY26 is brighter. With the elections behind, the government is expected to prioritise infrastructure projects, and there may be a renewed push for better coordination between central and state governments. Public investment, particularly in infrastructure, could see a rise in FY26, with a projected 13% year-on-year growth in capital expenditure, amounting to around INR 11 trillion.

However, the anticipated increase in capex will not be enough to offset the pressure on current expenditure. As a result, the government’s ability to meet the fiscal deficit target of 4.5% in FY26 will depend heavily on stringent expenditure controls and a reduction in non-essential spending.

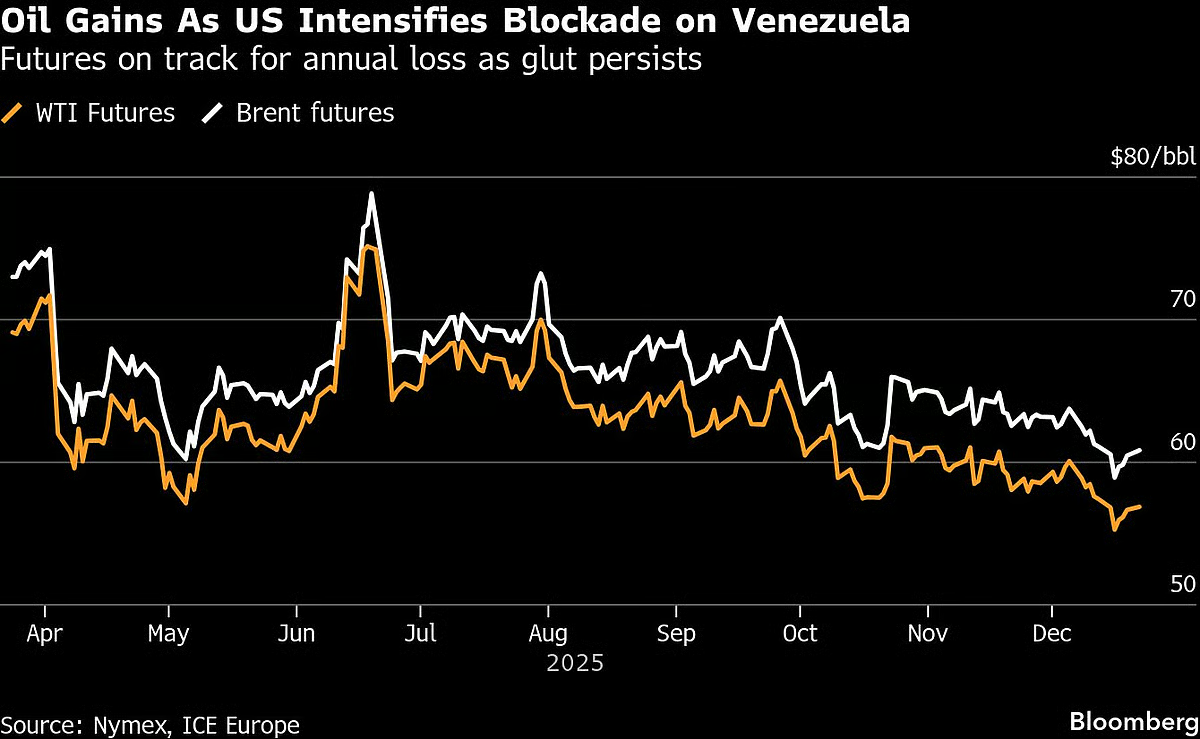

HSBC’s analysts also forecast that the Reserve Bank of India (RBI) will have to step in to support growth as the fiscal impulse remains neutral at best. With inflation moderating and growth slowing, the RBI is expected to ease monetary policy, potentially cutting the repo rate by 50 basis points in the first half of 2025.

While the FY25 budget may see an overachievement on fiscal deficit targets, the FY26 budget will likely face a much more challenging environment, with the government having to balance fiscal consolidation with the need for strategic investments in infrastructure. The key question will be whether the government can manage to trim its current expenditures without undermining economic recovery or public welfare.

. Read more on Budget by NDTV Profit.Revenue growth from taxes is expected to remain steady, but other sources of income, such as disinvestment receipts and capital gains taxes, are showing signs of weakness. Read MoreBudget, Economy & Finance

NDTV Profit