Global money managers appear to be turning away from India—once their top investment destination—as China’s tech-driven resurgence and Donald Trump’s ‘America First’ policies yield better reward.

China’s economic stimulus that began last October had sparked a renewed interest in an otherwise gloomy economy, with investors expecting more and more from each official meeting. Although not all the outcomes have given what investors anticipated, stocks got the boost they needed.

From endorsing their strongest pro-growth stance in a decade to providing a boost for the plaguing property market, China’s top leaders have signaled stronger stimulus to help fill a hole in consumer demand.

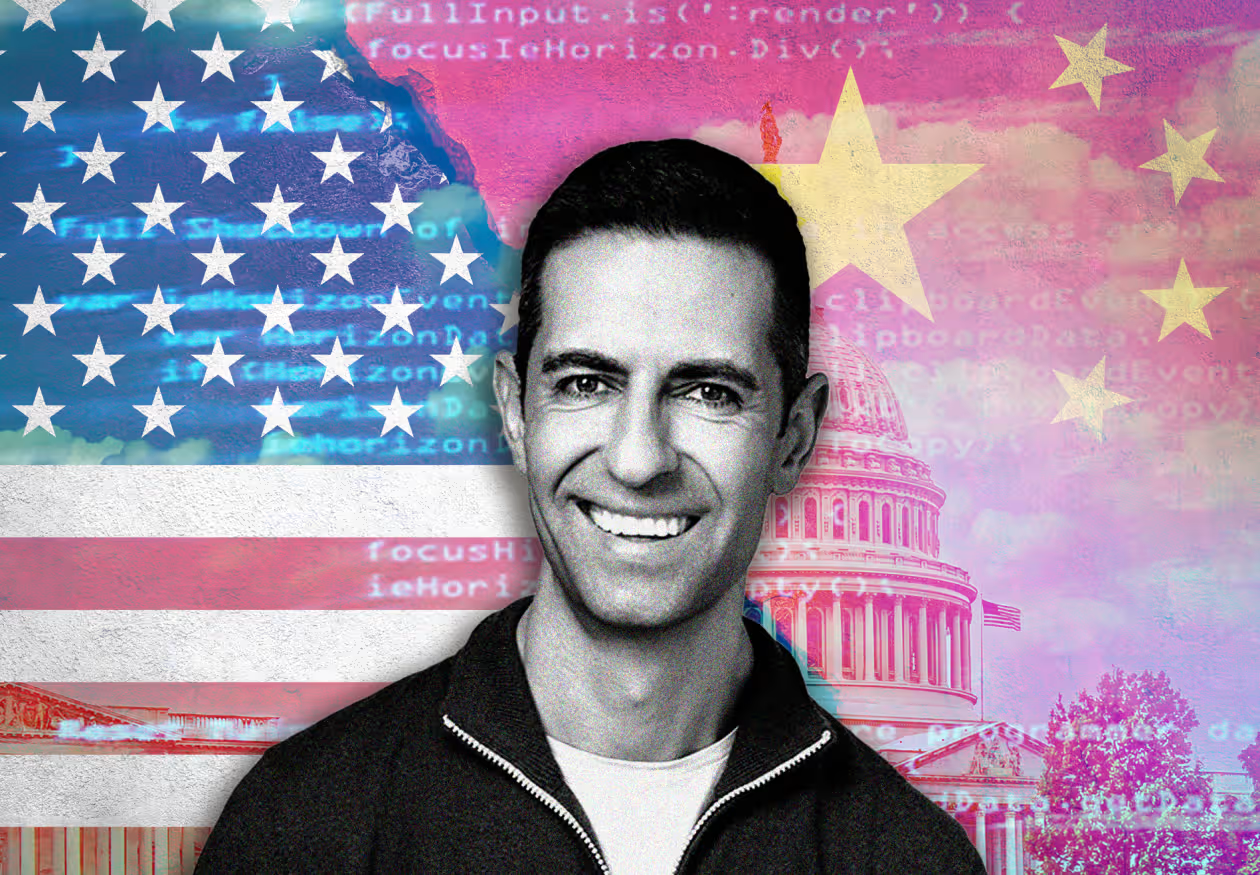

Even the Chief Equity Strategist – India, Morgan Stanley, underestimated China’s policy stimulus. “Initially, it seemed ineffective, but it ultimately marked the bottom for Chinese stocks and the top for Indian stocks,” Ridham Desai told NDTV Profit.

Since the stimulus talks began, China’s stock market has added over $2 trillion, although the final thrust to the rally was fueled by the tech breakthrough by DeepSeek. The Chinese artificial intelligence startup rocked global technology stocks, raising questions over United States technological dominance.

Speculations grew about DeepSeek’s AI model being cost-effective while running on less advanced chips, casting doubt on high valuations for companies like Nvidia Corp, which saw the worst ever market cap plunge. Even as other tech companies improvised their AI model, fund managers seem to favour the Chinese breakthrough.

President Xi Jinping’s recent meeting with the top businessmen and his message of a “clean relationship“ between business and government is seen as an attempt to stimulate the struggling Chinese economy, said V K Vijayakumar, chief investment strategist, Geojit Financial Services Ltd.

It remains to be seen whether this initiative, along with the breakthrough by DeepSeek, will lift the Chinese economy, Vijayakumar said.

All this while India has problems of its own. Slowing earnings and economic growth, high valuations and looming trade tensions have taken the shine from the once-favourite stock market.

Foreign institutional investors have offloaded stocks worth Rs 1.15 lakh crore in 2025 and sold stocks worth Rs 3.03 lakh crore since September, triggering the worst correction since Covid-19.

The data on inflows via global funds into China cannot be ascertained, as the country stopped publishing the figures since December last year.

The benchmark NSE Nifty 50 and the BSE Sensex have fallen 13.3% and 11.7%, respectively, from the previous peak, triggering the worst fall since 2020. India stocks’ overall market cap has plunged nearly $1.2 trillion since its peak last year to $3.99 trillion, according to Bloomberg data.

Amid this downturn, retail investors bore the brunt with their heavy investments in small and mid-cap stocks that saw a bigger rout.

India’s long-term growth story remains strong, near-term valuation worries and concerns over sluggish corporate earnings have led to profit-booking, according to Vaibhav Porwal, co-founder, Dezerv. Despite the recent correction, stocks continues to trade at a premium compared to other emerging markets, he said.

Indian stocks remain under pressure, even as two key macroeconomic events — union budget’s tax sops and central bank’s rate cuts —failed to lift investor sentiments.

India faces additional pressure from Trump’s trade policies aimed at ‘making America great again’. With US bond yields, the dollar, and the world’s largest stock market surging, money managers are finding better returns elsewhere amid volatile times. India is poised to be among the worst affected by Trump’s reciprocal tariffs, according to Nomura Research.

Higher bond yields are driving inflows back into the US, according to Abhay Agarwal, managing director, Piper Serica Advisors. India’s attractiveness for foreign investors lie in its strong consumption base, he said. “Don’t see a reversal of FPI money in Indian markets till US bond yields cool and domestic demand picks up.”

Even top analysts are divided on the revival of Indian stocks, but they agree that inflows by global funds will not boost the market.

Investors don’t have confidence in the Chinese stock market. However, the valuations are cheap as the Shanghai Composite Index is down 44% from the 2007 peak, Vijayakumar said. The Hang Seng Index, where FIIs buy Chinese stocks, is now trading at a price-to-earnings ratio of 12.6 times, compared to 21 times in India’s Nifty.

The US will continue to attract inflows, so long as the dollar remains strong. But it appears that the dollar has peaked, Vijayakumar said. “FII flows will return to India when data indicates revival of corporate earnings in India. This can happen in early fiscal 2026.”

FII flows could return to India in the next three to six months, as the economy and macro factors in the long term are favourable, Porwal said, adding that strong domestic demand, digital transformation, and infrastructure push are long-term drivers that are likely to bolster corporate earnings.

. Read more on Markets by NDTV Profit.India is poised to be among the worst affected by Trump’s reciprocal tariffs, according to Nomura Research. Read MoreMarkets, Business, Notifications

NDTV Profit