The confrontation between the U.S. and the EU has entered a new phase. The U.S. president is taking a hardline approach toward Europe, effectively following a “tit for tat” strategy. After the EU decided to impose retaliatory tariffs, setting a 50% duty on U.S. imports of alcohol and other goods, Trump responded with a 200% counter-tariff. This escalating trade war between the U.S. and Europe has reached almost absurd proportions, yet its consequences are having a serious impact on investors and global financial markets.

Current investor sentiment toward geopolitical developments is clearly reflected in the performance of U.S. Treasury bonds, which have stabilized in yield amid extreme uncertainty about the future direction of U.S. policy. The yield on 10-year Treasury bonds has hovered just below 4.3% since early March, reflecting market indecision.

The Debt Ceiling: Another Risk for the Markets

Beyond trade wars, another major uncertainty is looming over the markets—the unresolved debt ceiling issue. Under Joe Biden’s administration, this problem was simply resolved by raising the ceiling, but Trump’s administration may not follow the same approach. Trump came to power not only with the slogan “Make America Great Again” but also with promises to implement a more responsible economic policy, aiming to cut government spending.

Amid this backdrop, some market voices are already warning of a potential U.S. default as early as this summer. If this scenario materializes, the U.S. economy could face severe financial pressure, leading to a decline in demand for American stocks. In such a situation, stock indices could suffer significant losses, and even a slowdown in inflation or a 0.25% Fed rate cut might not be enough to provide support.

If this issue remains unresolved and a U.S. default becomes inevitable, the S&P 500 broad-market index could plunge to the 4,000-point level—a key level from which the index rallied in spring 2023, driven by the attractiveness of U.S. assets amid the war in Ukraine and rising global geopolitical tensions.

What to Expect in the Markets Today?

The trade war narrative is likely to dominate the markets once again. After a possible short-term recovery in U.S. equities today, the market is likely to resume its decline. Neither lower consumer inflation nor slowing producer price inflation—which could support a 0.25% Fed rate cut—are likely to offset the uncertainty surrounding trade wars, the Ukraine conflict, and the U.S. debt ceiling issue. Investors are expected to remain highly cautious.

In this environment, gold prices will likely continue to rise, along with the U.S. dollar, while demand for cryptocurrencies will remain under pressure, along with crude oil prices.

Daily Forecast:

#SPX

The S&P 500 CFD contract may receive temporary support, rising toward 5,645.00 as traders lock in previous gains. However, a potential reversal to the downside could follow, leading to a drop toward 5,500.00.

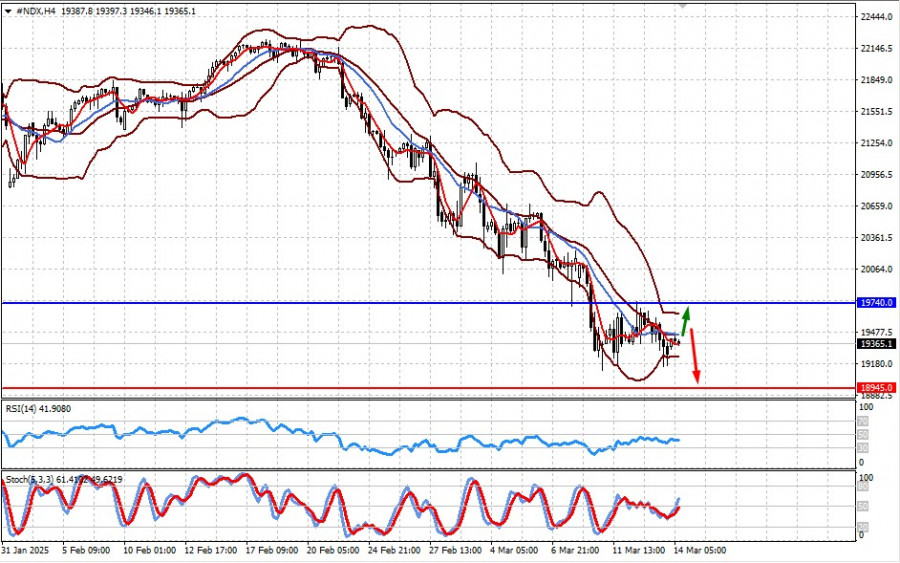

#NDX

The NASDAQ 100 CFD contract could also receive temporary support, climbing to 19,740.00, driven by expectations surrounding U.S.-Russia talks on Ukraine. However, the index may then reverse downward, with a potential decline toward 18,945.00.

The material has been provided by InstaForex Company – www.instaforex.comThe confrontation between the U.S. and the EU has entered a new phase. The U.S. president is taking a hardline approach toward Europe, effectively following a “tit for tat” strategy. After the EU decided to impose retaliatory tariffs, setting a 50% duty on U.S. imports of alcohol and other goods, Trump responded with a 200% counter-tariff. This escalating trade war between the U.S. and Europe has reached almost absurd proportions, yet its consequences are having a serious impact on investors and global financial markets.Current investor sentiment toward geopolitical developments is clearly reflected in the performance of U.S. Treasury bonds, which have stabilized in yield amid extreme uncertainty about the future direction of U.S. policy. The yield on 10-year Treasury bonds has hovered just below 4.3% since early March, reflecting market indecision.The Debt Ceiling: Another Risk for the MarketsBeyond trade wars, another major uncertainty is looming over the markets—the unresolved debt ceiling issue. Under Joe Biden’s administration, this problem was simply resolved by raising the ceiling, but Trump’s administration may not follow the same approach. Trump came to power not only with the slogan “Make America Great Again” but also with promises to implement a more responsible economic policy, aiming to cut government spending.Amid this backdrop, some market voices are already warning of a potential U.S. default as early as this summer. If this scenario materializes, the U.S. economy could face severe financial pressure, leading to a decline in demand for American stocks. In such a situation, stock indices could suffer significant losses, and even a slowdown in inflation or a 0.25% Fed rate cut might not be enough to provide support.If this issue remains unresolved and a U.S. default becomes inevitable, the S&P 500 broad-market index could plunge to the 4,000-point level—a key level from which the index rallied in spring 2023, driven by the attractiveness of U.S. assets amid the war in Ukraine and rising global geopolitical tensions.What to Expect in the Markets Today?The trade war narrative is likely to dominate the markets once again. After a possible short-term recovery in U.S. equities today, the market is likely to resume its decline. Neither lower consumer inflation nor slowing producer price inflation—which could support a 0.25% Fed rate cut—are likely to offset the uncertainty surrounding trade wars, the Ukraine conflict, and the U.S. debt ceiling issue. Investors are expected to remain highly cautious.In this environment, gold prices will likely continue to rise, along with the U.S. dollar, while demand for cryptocurrencies will remain under pressure, along with crude oil prices.Daily Forecast: #SPXThe S&P 500 CFD contract may receive temporary support, rising toward 5,645.00 as traders lock in previous gains. However, a potential reversal to the downside could follow, leading to a drop toward 5,500.00.#NDXThe NASDAQ 100 CFD contract could also receive temporary support, climbing to 19,740.00, driven by expectations surrounding U.S.-Russia talks on Ukraine. However, the index may then reverse downward, with a potential decline toward 18,945.00.The material has been provided by InstaForex Company – www.instaforex.com Read More

Forex analysis review