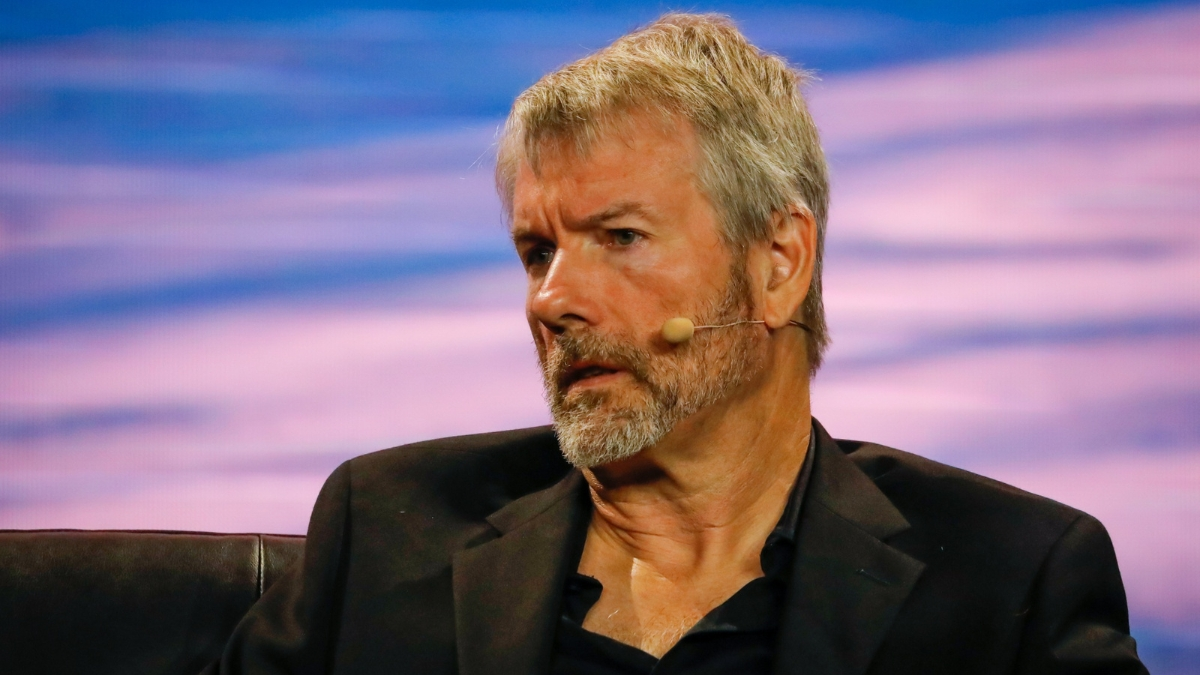

The global digital asset market printed and remained red on Tuesday as Bitcoin (BTC) price took a straight dump of more than 5% in the last 24 hours. Amid the increased volatility in the market, Michael Saylor gave out a recommendation to the crypto investors.

Michael Saylor on crypto decline

Former CEO of MicroStrategy, Michael Saylor in a post wrote that “Bet on the Future”. It is important to note that Saylor makes most of the cryptic posts over Bitcoin, most of which bullish messages for the market.

As of March 19, 2024, MicroStrategy owns 214,246 bitcoins. It has stated that their BTC average purchase price is $33,706.00 with a total cost of $6.91 billion.

Michael Saylor’s post comes in when the crypto market saw the second biggest Bitcoin outflow from the crypto exchange Coinbase within a week. However, this outflow raised speculation about institutional purchases or Spot ETFs.

The report mentioned that the consecutive outflows total approximately 33.8K Bitcoin. It directly suggests a huge activity within the institutional investor space.

Meanwhile, data indicates a flush in Binance’s Open Interest (OI) which can be a trend of retail investors leaving their long positions. This shift in sentiment among retail investors may pave the way for further price surges as selling pressure drops.

Why market is down today?

The global crypto market cap dropped by more than 6% in the last 24 hours to stand at $2.47 trillion. Bitcoin price is down by 6% in the last 7 days. BTC is trading at an average price of $65,790, at the press time.

It added that the 10 year US Treasury yield reached its highest level of the year. This comes in when the dollar surged to its highest level in almost five months, creating headwinds for Bitcoin. The crypto market’s reaction might be influenced by stronger than expected economic data with growing concerns about inflation,

The market downturn may have been exacerbated by a significant Bitcoin transfer to the Bitfinex exchange by a large holder, indicating potential selling activity. This coincided with a sharp drop in Bitcoin’s price late Monday night.

Stocks tied to Bitcoin’s performance also faced downward pressure, with crypto exchange Coinbase falling 4% and software provider MicroStrategy, often viewed as a proxy for Bitcoin’s price, losing nearly 7%.

Major mining stocks like Marathon Digital and Riot Platforms experienced losses of 7% and 6%, respectively, while CleanSpark, one of the year’s best-performing miners, slid 6%.

The global digital asset market printed and remained red on Tuesday as Bitcoin (BTC) price took a straight dump of more than 5% in the last 24 hours. Amid the increased volatility in the market, Michael Saylor gave out a recommendation to the crypto investors. Michael Saylor on crypto decline Former CEO of MicroStrategy, Michael […] Read MoreNews, Bitcoin, Crypto, SEC

Todayq News