Something strange and peculiar is happening in the market. For instance, on Wednesday, the pair sharply grew after the eurozone inflation data, but then it completely reversed all that movement. Take note that inflation in Europe continues to decline. Something similar happened on Friday as well. The dollar sharply strengthened at one point, which was understandable considering the published data. According to the report from the United States Department of Labor, the unemployment rate decreased from 3.9% to 3.8%, and the economy added 303,000 new jobs outside of agriculture. This amount is enough to maintain labor market stability, and at most, it creates conditions for the unemployment rate to fall further. So it was logical for the dollar to rise. However, it didn’t last long. A retracement began almost immediately, and the market returned to the levels it was at before the report was published. It was quite interesting that leading financial media outlets did not mention anything about this. Apparently, everyone was surprised with what happened. After all, there is no logic behind this. But as I mentioned above, this is not the first time it happened. In this case, it is quite difficult to try to formulate any hypotheses regarding further developments. Especially since the economic calendar is empty today. And logically, the market should stand still. However, there is a possibility that albeit with a delay, the market will eventually start reacting to Friday’s labor market data. However, this is highly unlikely.

Speculation continues to play a key role in financial markets, as evidenced by the EUR/USD pair’s movement last Friday. The quote initially dropped below the 1.0800 level, but then it swiftly recovered despite the fundamental analysis suggesting that the dollar would strengthen.

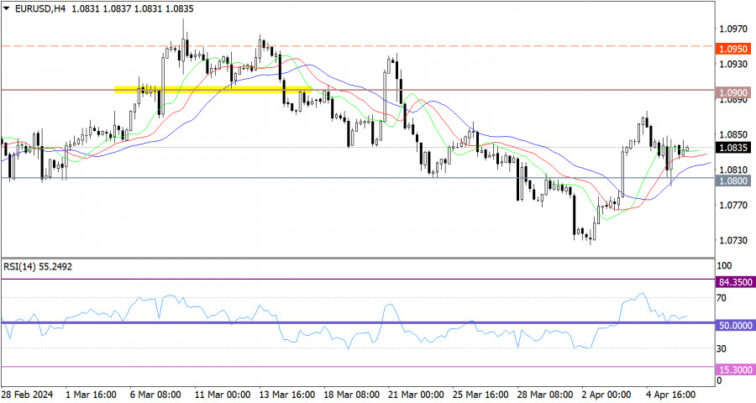

On the 4-hour chart, the RSI reached the oversold zone when the pair was following a bearish momentum. Afterward, the indicator retreated to the 50 line, which corresponds to the quote’s movement.

On the same chart, the Alligator’s MAs are headed upwards, ignoring all recent speculations. However, on the hourly chart, the MA lines are intertwined, indicating a stagnant phase.

Outlook

In this situation, technical analysis indicates that the euro may strengthen further, but the fundamental analysis suggests that the volume of short positions may increase. Such a discrepancy may lead to a stagnant phase, and it is already evident on the trading chart in the form of a doji candlestick. We may also consider another scenario, in which technical and fundamental analyses are ignored, and speculation prevails in the market, which may go against common sense.

In terms of complex indicator analysis, indicators point to mixed sentiment in the short-term and intraday periods.

The material has been provided by InstaForex Company – www.instaforex.comSomething strange and peculiar is happening in the market. For instance, on Wednesday, the pair sharply grew after the eurozone inflation data, but then it completely reversed all that movement. Take note that inflation in Europe continues to decline. Something similar happened on Friday as well. The dollar sharply strengthened at one point, which was understandable considering the published data. According to the report from the United States Department of Labor, the unemployment rate decreased from 3.9% to 3.8%, and the economy added 303,000 new jobs outside of agriculture. This amount is enough to maintain labor market stability, and at most, it creates conditions for the unemployment rate to fall further. So it was logical for the dollar to rise. However, it didn’t last long. A retracement began almost immediately, and the market returned to the levels it was at before the report was published. It was quite interesting that leading financial media outlets did not mention anything about this. Apparently, everyone was surprised with what happened. After all, there is no logic behind this. But as I mentioned above, this is not the first time it happened. In this case, it is quite difficult to try to formulate any hypotheses regarding further developments. Especially since the economic calendar is empty today. And logically, the market should stand still. However, there is a possibility that albeit with a delay, the market will eventually start reacting to Friday’s labor market data. However, this is highly unlikely. Speculation continues to play a key role in financial markets, as evidenced by the EUR/USD pair’s movement last Friday. The quote initially dropped below the 1.0800 level, but then it swiftly recovered despite the fundamental analysis suggesting that the dollar would strengthen.On the 4-hour chart, the RSI reached the oversold zone when the pair was following a bearish momentum. Afterward, the indicator retreated to the 50 line, which corresponds to the quote’s movement.On the same chart, the Alligator’s MAs are headed upwards, ignoring all recent speculations. However, on the hourly chart, the MA lines are intertwined, indicating a stagnant phase.OutlookIn this situation, technical analysis indicates that the euro may strengthen further, but the fundamental analysis suggests that the volume of short positions may increase. Such a discrepancy may lead to a stagnant phase, and it is already evident on the trading chart in the form of a doji candlestick. We may also consider another scenario, in which technical and fundamental analyses are ignored, and speculation prevails in the market, which may go against common sense.In terms of complex indicator analysis, indicators point to mixed sentiment in the short-term and intraday periods.The material has been provided by InstaForex Company – www.instaforex.com Read More

Forex analysis review