In my morning forecast, I paid attention to the 1.0722 level and planned to make decisions on entering the market from it. Let’s look at the 5-minute chart and figure out what happened there. Declines and the formation of a false breakdown gave a signal to buy the euro, but it never reached normal growth, after which the euro continued to fall. But with purchases on a false breakout in the area of 1.0677, we were lucky. They managed to pull more than 30 points of profit from the market. In the afternoon, the technical picture was slightly revised.

To open long positions on EURUSD, you need:

The euro continued to fall, as expected, and this is not surprising. After buyers were disappointed with the upward movement of the pair yesterday, the scales shifted to the sellers, who continued the bearish trend with great pleasure today. In the afternoon, figures on the consumer sentiment index from the University of Michigan and inflation expectations are expected. But be careful. Even good data on the United States can lead to a slight pull of the pair down, after which the market will turn around by analogy with yesterday. Therefore, the formation of a false breakout in the area of 1.0675 will be a suitable entry point into long positions in order to update 1.0710, the resistance formed at the end of the first half of the day. A breakout and a top-down update of this range will lead to a strengthening of the pair with a chance of growth in the area of 1.0743. The farthest target will be a maximum of 1.0783, where I will record profits. A test of this level will bring the market back to balance. If EUR/USD declines and there is no activity around 1.0675 in the afternoon, the pressure on the pair will noticeably increase, which will lead to a new drop. In this case, I will enter only after the formation of a false breakdown in the area of the next support of 1.0642. I’m going to open long positions immediately for a rebound from 1.0601 with the aim of an upward correction of 30-35 points within the day.

To open short positions on EURUSD, you need:

Sellers have proved themselves, and so far, they keep the market under their control. In the afternoon, it will be enough for them to prove themselves around 1.0710. A false breakout will result in a suitable entry point into short positions in order to drop the pair further to the support of 1.0675. Given that this level has already played itself out once, a breakout and consolidation below this range, as well as a reverse bottom-up test, will give another selling point with a move to the area of a new low of 1.0642, where I expect to see a more active manifestation of bulls. The farthest target will be at least 1.0601, where I will record profits. In the event of an upward movement of EUR/USD in the afternoon, as well as the absence of bears at 1.0710, buyers will be able to win back most of the losses. In this case, I will postpone sales until the test of the next resistance of 1.0743. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately for a rebound from 1.0783 with the aim of a downward correction of 30-35 points.

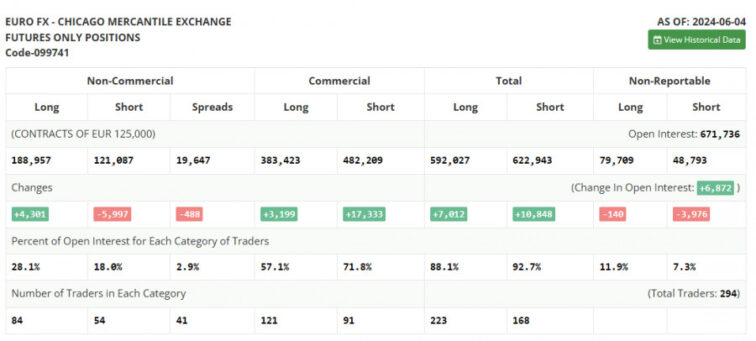

The COT report (Commitment of Traders) for June 4 showed an increase in long positions and a reduction in short ones. It is worth noting that the report has yet to show the changes that occurred in the market after the European Central Bank meeting and the US labor market data, so you can not pay much attention to these indicators. We have a meeting of the US central bank’s open market committee ahead, at which decisions on interest rates will be made. Most likely, everything will remain unchanged, and the timing of the first decline will be shifted to a later one. All this will help the dollar and lead to an even greater weakening of risky assets, including the European currency. The COT report indicates that long non-profit positions increased by 4,301 to the level of 188,957, while short non-profit positions fell by 5,997 to the level of 121,087. As a result, the spread between long and short positions decreased by 488.

Indicator Signals:

Moving Averages:

Trading is below the 30 and 50-day moving averages, indicating further decline of the pair.

Note: The author examines the period and prices of moving averages on the H1 hourly chart, differing from the general definition of classic daily moving averages on the D1 daily chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.0740, will act as support.

Description of Indicators:

Moving Average: Defines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.Moving Average: Defines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.Bollinger Bands: Period 20.Non-Commercial Traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.Long Non-Commercial Positions: Represent the total long open position of non-commercial traders.Short Non-Commercial Positions: Represent the total short open position of non-commercial traders.Total Non-Commercial Net Position: The difference between short and long positions of non-commercial traders.The material has been provided by InstaForex Company – www.instaforex.comIn my morning forecast, I paid attention to the 1.0722 level and planned to make decisions on entering the market from it. Let’s look at the 5-minute chart and figure out what happened there. Declines and the formation of a false breakdown gave a signal to buy the euro, but it never reached normal growth, after which the euro continued to fall. But with purchases on a false breakout in the area of 1.0677, we were lucky. They managed to pull more than 30 points of profit from the market. In the afternoon, the technical picture was slightly revised.To open long positions on EURUSD, you need: The euro continued to fall, as expected, and this is not surprising. After buyers were disappointed with the upward movement of the pair yesterday, the scales shifted to the sellers, who continued the bearish trend with great pleasure today. In the afternoon, figures on the consumer sentiment index from the University of Michigan and inflation expectations are expected. But be careful. Even good data on the United States can lead to a slight pull of the pair down, after which the market will turn around by analogy with yesterday. Therefore, the formation of a false breakout in the area of 1.0675 will be a suitable entry point into long positions in order to update 1.0710, the resistance formed at the end of the first half of the day. A breakout and a top-down update of this range will lead to a strengthening of the pair with a chance of growth in the area of 1.0743. The farthest target will be a maximum of 1.0783, where I will record profits. A test of this level will bring the market back to balance. If EUR/USD declines and there is no activity around 1.0675 in the afternoon, the pressure on the pair will noticeably increase, which will lead to a new drop. In this case, I will enter only after the formation of a false breakdown in the area of the next support of 1.0642. I’m going to open long positions immediately for a rebound from 1.0601 with the aim of an upward correction of 30-35 points within the day.To open short positions on EURUSD, you need: Sellers have proved themselves, and so far, they keep the market under their control. In the afternoon, it will be enough for them to prove themselves around 1.0710. A false breakout will result in a suitable entry point into short positions in order to drop the pair further to the support of 1.0675. Given that this level has already played itself out once, a breakout and consolidation below this range, as well as a reverse bottom-up test, will give another selling point with a move to the area of a new low of 1.0642, where I expect to see a more active manifestation of bulls. The farthest target will be at least 1.0601, where I will record profits. In the event of an upward movement of EUR/USD in the afternoon, as well as the absence of bears at 1.0710, buyers will be able to win back most of the losses. In this case, I will postpone sales until the test of the next resistance of 1.0743. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately for a rebound from 1.0783 with the aim of a downward correction of 30-35 points.The COT report (Commitment of Traders) for June 4 showed an increase in long positions and a reduction in short ones. It is worth noting that the report has yet to show the changes that occurred in the market after the European Central Bank meeting and the US labor market data, so you can not pay much attention to these indicators. We have a meeting of the US central bank’s open market committee ahead, at which decisions on interest rates will be made. Most likely, everything will remain unchanged, and the timing of the first decline will be shifted to a later one. All this will help the dollar and lead to an even greater weakening of risky assets, including the European currency. The COT report indicates that long non-profit positions increased by 4,301 to the level of 188,957, while short non-profit positions fell by 5,997 to the level of 121,087. As a result, the spread between long and short positions decreased by 488.Indicator Signals:Moving Averages:Trading is below the 30 and 50-day moving averages, indicating further decline of the pair.Note: The author examines the period and prices of moving averages on the H1 hourly chart, differing from the general definition of classic daily moving averages on the D1 daily chart.Bollinger Bands:In case of a decline, the lower boundary of the indicator, around 1.0740, will act as support.Description of Indicators:Moving Average: Defines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.Moving Average: Defines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.Bollinger Bands: Period 20.Non-Commercial Traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet certain requirements.Long Non-Commercial Positions: Represent the total long open position of non-commercial traders.Short Non-Commercial Positions: Represent the total short open position of non-commercial traders.Total Non-Commercial Net Position: The difference between short and long positions of non-commercial traders.The material has been provided by InstaForex Company – www.instaforex.com Read More

Forex analysis review