The Nasdaq and S&P 500 indexes hit new record highs on Wednesday, driven by gains in Nvidia and other major Wall Street names ahead of inflation data and quarterly earnings reports due this week.

It was the Nasdaq’s seventh straight record close, while the S&P 500 posted its sixth. The S&P 500 broke 5,600 for the first time after Federal Reserve Chairman Jerome Powell raised expectations for a rate cut in September.

In testimony to Congress, Powell said it was too early to say inflation was completely conquered, but stressed that the U.S. was moving toward stable prices and low unemployment, and that the Fed would monitor that process closely.

Powell also said Tuesday that with the U.S. economy no longer in overheating mode, the central bank could take risks into account and would be prepared to cut rates once inflation showed significant progress.

Investors are looking ahead to June consumer price index data on Thursday and producer price index data on Friday, hoping that the data will bolster confidence that the Fed will be able to cut rates this year.

Traders are currently pricing a 46% chance that the Fed will cut rates by two points by the end of December, and a 70% chance of the first cut as early as September, according to CME Group’s FedWatch tool.

The Philadelphia Semiconductor Index (.SOX) rose 2.4% to a new high after contract manufacturer Taiwan Semiconductor Manufacturing Co reported strong quarterly earnings.

“The TSMC report gave artificial intelligence a boost, and that’s probably the most meaningful data point right now,” said Thomas Martin, senior portfolio manager at Globalt Investments in Atlanta.

Micron Technology (MU.O) jumped 4%, Nvidia (NVDA.O) rose 2.7%, and Advanced Micro Devices (AMD.O) rose 3.9%.

Apple (AAPL.O) shares rose 1.9% to a new record, pushing the company’s market value to $3.6 trillion.

While Wall Street’s gains this year have been driven largely by a few big names, some investors are worried about a potential sell-off if earnings miss expectations.

The S&P 500 rose 1.02% to close at 5,633.91.

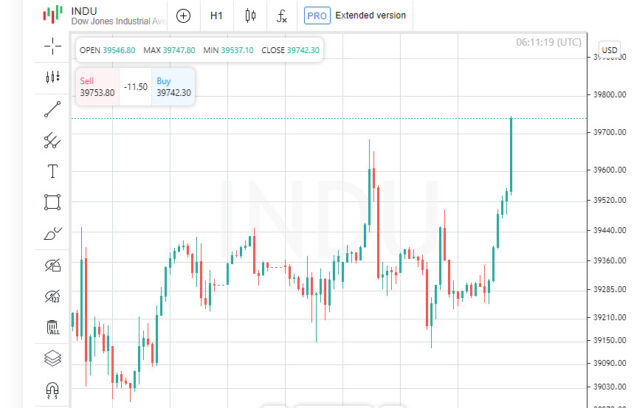

On Wall Street, the Dow Jones Industrial Average (.DJI) rose 429.39 points, or 1.09%, to 39,721.36, the S&P 500 (.SPX) added 56.93 points, or 1.02%, to 5,633.91 and the Nasdaq Composite (.IXIC) rose 218.16 points, or 1.18%, to 18,647.45.

All 11 S&P 500 sector indexes were up Wednesday, with information technology (.SPLRCT) leading the way with a 1.63% gain, followed by materials (.SPLRCM) with a 1.34% gain.

Volume on U.S. exchanges was relatively light on Wednesday, with 10 billion shares traded, below the 11.5 billion average for the past 20 trading sessions.

Ahead of U.S. inflation data, including the consumer price index on Thursday and the producer price index on Friday, are keeping investors’ attention.

The probability of a 25 basis point rate cut by September has risen to 74%, up from 70% on Tuesday and 45% a month ago, according to CME’s FedWatch data.

The second-quarter earnings season, which begins this week with the largest banks reporting on Friday, will be a test for large, large-cap companies to justify their lofty estimates and prove continued growth.

Intuit (INTU.O) shares fell 2.6% after announcing plans to cut about 10% of its workforce.

Shares of gene sequencing equipment maker Illumina (ILMN.O) rose more than 6% after announcing it would acquire privately held Fluent BioSciences.

Advancing stocks outnumbered decliners in the S&P 500 (.AD.SPX) 4.3-to-1. The S&P 500 posted 33 new highs and 11 new lows; the Nasdaq posted 65 new highs and 117 new lows.

The U.S. dollar weakened, while the euro gained slightly and sterling rose as comments from the Bank of England’s chief economist reduced expectations for an interest rate cut in August.

The MSCI Worldwide Index (.MIWD00000PUS) rose 7.03 points, or 0.86%, to 824.81. It was the world index’s sixth record close in the last seven sessions and its biggest one-day percentage gain since June 12.

Europe’s STOXX 600 index (.STOXX) also closed up 0.91%.

In Treasurys, Powell’s dovish comments helped push yields lower, while a successful auction of 10-year U.S. Treasuries pushed rates up slightly, putting pressure on yields.

The 10-year U.S. Treasury yield fell 1.8 basis points to 4.282% from 4.3% late Tuesday, while the 30-year yield fell 2.5 basis points to 4.4702%.

The 2-year yield, which typically reflects interest rate expectations, fell 0.6 basis points to 4.6221% from 4.628% late Tuesday.

In the currency market, the dollar weakened as investors focused on the possibility of a rate cut as Powell wrapped up his remarks.

The dollar index, which measures the dollar against a basket of currencies including the yen and euro, was down 0.09% at 105.02. The euro was up 0.13% at $1.0826, while sterling was up 0.48% at $1.2844.

However, the dollar was up 0.26% at 161.73 against the Japanese yen.

Oil prices rose after data showed a big increase in U.S. refining activity last week.

That led to a bigger-than-expected rise in gasoline and crude inventories, but Hurricane Beryl caused only minimal supply disruptions, limiting price gains.

U.S. crude oil prices rose 0.85%, or 69 cents, to $82.10 a barrel, while Brent crude rose 0.5%, or 42 cents, to $85.08 a barrel.

Gold prices also rose on expectations of a U.S. interest rate cut. Investors are awaiting inflation data due on Thursday for further confirmation of those expectations.

Spot gold rose 0.36% to $2,372.25 an ounce, while U.S. gold futures rose 0.72% to $2,377.00 an ounce.

The material has been provided by InstaForex Company – www.instaforex.comThe Nasdaq and S&P 500 indexes hit new record highs on Wednesday, driven by gains in Nvidia and other major Wall Street names ahead of inflation data and quarterly earnings reports due this week.

It was the Nasdaq’s seventh straight record close, while the S&P 500 posted its sixth. The S&P 500 broke 5,600 for the first time after Federal Reserve Chairman Jerome Powell raised expectations for a rate cut in September.

In testimony to Congress, Powell said it was too early to say inflation was completely conquered, but stressed that the U.S. was moving toward stable prices and low unemployment, and that the Fed would monitor that process closely.

Powell also said Tuesday that with the U.S. economy no longer in overheating mode, the central bank could take risks into account and would be prepared to cut rates once inflation showed significant progress.

Investors are looking ahead to June consumer price index data on Thursday and producer price index data on Friday, hoping that the data will bolster confidence that the Fed will be able to cut rates this year.

Traders are currently pricing a 46% chance that the Fed will cut rates by two points by the end of December, and a 70% chance of the first cut as early as September, according to CME Group’s FedWatch tool.

The Philadelphia Semiconductor Index (.SOX) rose 2.4% to a new high after contract manufacturer Taiwan Semiconductor Manufacturing Co reported strong quarterly earnings.

“The TSMC report gave artificial intelligence a boost, and that’s probably the most meaningful data point right now,” said Thomas Martin, senior portfolio manager at Globalt Investments in Atlanta.

Micron Technology (MU.O) jumped 4%, Nvidia (NVDA.O) rose 2.7%, and Advanced Micro Devices (AMD.O) rose 3.9%.

Apple (AAPL.O) shares rose 1.9% to a new record, pushing the company’s market value to $3.6 trillion.

While Wall Street’s gains this year have been driven largely by a few big names, some investors are worried about a potential sell-off if earnings miss expectations.

The S&P 500 rose 1.02% to close at 5,633.91.

On Wall Street, the Dow Jones Industrial Average (.DJI) rose 429.39 points, or 1.09%, to 39,721.36, the S&P 500 (.SPX) added 56.93 points, or 1.02%, to 5,633.91 and the Nasdaq Composite (.IXIC) rose 218.16 points, or 1.18%, to 18,647.45.

All 11 S&P 500 sector indexes were up Wednesday, with information technology (.SPLRCT) leading the way with a 1.63% gain, followed by materials (.SPLRCM) with a 1.34% gain.

Volume on U.S. exchanges was relatively light on Wednesday, with 10 billion shares traded, below the 11.5 billion average for the past 20 trading sessions.

Ahead of U.S. inflation data, including the consumer price index on Thursday and the producer price index on Friday, are keeping investors’ attention.

The probability of a 25 basis point rate cut by September has risen to 74%, up from 70% on Tuesday and 45% a month ago, according to CME’s FedWatch data.

The second-quarter earnings season, which begins this week with the largest banks reporting on Friday, will be a test for large, large-cap companies to justify their lofty estimates and prove continued growth.

Intuit (INTU.O) shares fell 2.6% after announcing plans to cut about 10% of its workforce.

Shares of gene sequencing equipment maker Illumina (ILMN.O) rose more than 6% after announcing it would acquire privately held Fluent BioSciences.

Advancing stocks outnumbered decliners in the S&P 500 (.AD.SPX) 4.3-to-1. The S&P 500 posted 33 new highs and 11 new lows; the Nasdaq posted 65 new highs and 117 new lows.

The U.S. dollar weakened, while the euro gained slightly and sterling rose as comments from the Bank of England’s chief economist reduced expectations for an interest rate cut in August.

The MSCI Worldwide Index (.MIWD00000PUS) rose 7.03 points, or 0.86%, to 824.81. It was the world index’s sixth record close in the last seven sessions and its biggest one-day percentage gain since June 12.

Europe’s STOXX 600 index (.STOXX) also closed up 0.91%.

In Treasurys, Powell’s dovish comments helped push yields lower, while a successful auction of 10-year U.S. Treasuries pushed rates up slightly, putting pressure on yields.

The 10-year U.S. Treasury yield fell 1.8 basis points to 4.282% from 4.3% late Tuesday, while the 30-year yield fell 2.5 basis points to 4.4702%.

The 2-year yield, which typically reflects interest rate expectations, fell 0.6 basis points to 4.6221% from 4.628% late Tuesday.

In the currency market, the dollar weakened as investors focused on the possibility of a rate cut as Powell wrapped up his remarks.

The dollar index, which measures the dollar against a basket of currencies including the yen and euro, was down 0.09% at 105.02. The euro was up 0.13% at $1.0826, while sterling was up 0.48% at $1.2844.

However, the dollar was up 0.26% at 161.73 against the Japanese yen.Oil prices rose after data showed a big increase in U.S. refining activity last week.

That led to a bigger-than-expected rise in gasoline and crude inventories, but Hurricane Beryl caused only minimal supply disruptions, limiting price gains.

U.S. crude oil prices rose 0.85%, or 69 cents, to $82.10 a barrel, while Brent crude rose 0.5%, or 42 cents, to $85.08 a barrel.

Gold prices also rose on expectations of a U.S. interest rate cut. Investors are awaiting inflation data due on Thursday for further confirmation of those expectations.

Spot gold rose 0.36% to $2,372.25 an ounce, while U.S. gold futures rose 0.72% to $2,377.00 an ounce.The material has been provided by InstaForex Company – www.instaforex.com Read More

Forex analysis review