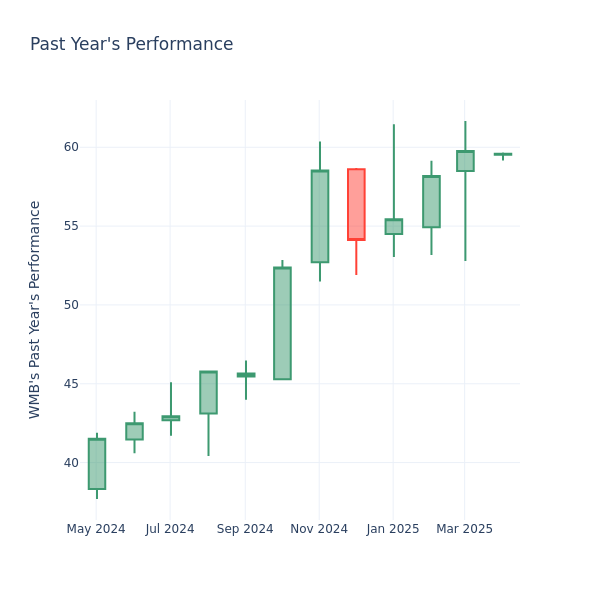

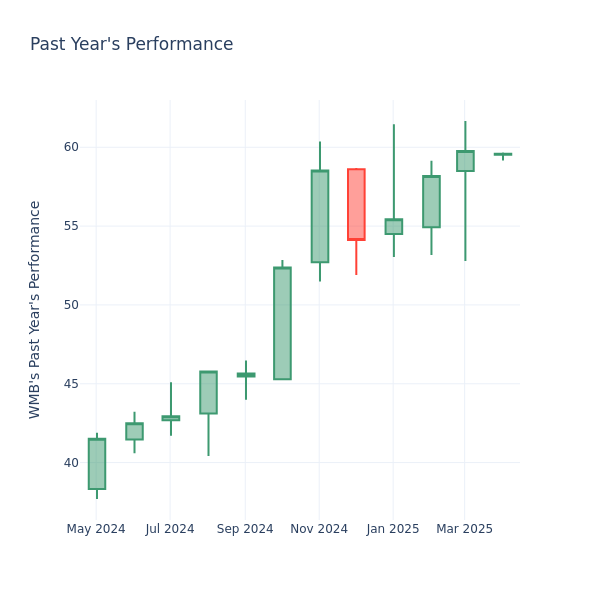

In the current market session, Williams Companies Inc. (NYSE:WMB) stock price is at $59.58, after a 0.30% drop. However, over the past month, the company’s stock went up by 4.89%, and in the past year, by 51.41%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is not performing up to par in the current session.

Williams Companies P/E Compared to Competitors

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past …

Full story available on Benzinga.com

In the current market session, Williams Companies Inc. (NYSE:WMB) stock price is at $59.58, after a 0.30% drop. However, over the past month, the company’s stock went up by 4.89%, and in the past year, by 51.41%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is not performing up to par in the current session.

Williams Companies P/E Compared to Competitors

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past …

Full story available on Benzinga.com

In the current market session, Williams Companies Inc. (NYSE:WMB) stock price is at $59.58, after a 0.30% drop. However, over the past month, the company’s stock went up by 4.89%, and in the past year, by 51.41%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is not performing up to par in the current session.

Williams Companies P/E Compared to Competitors

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past …Full story available on Benzinga.com Read MoreBZI-PE, News, WMB, Intraday Update, Markets, WMB, US9694571004, News, Intraday Update, Markets, Benzinga News