Whales with a lot of money to spend have taken a noticeably bullish stance on Snowflake.

Looking at options history for Snowflake (NYSE:SNOW) we detected 46 trades.

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 23 are puts, for a total amount of $1,451,282 and 23, calls, for a total amount of $965,956.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $250.0 for Snowflake over the last 3 months.

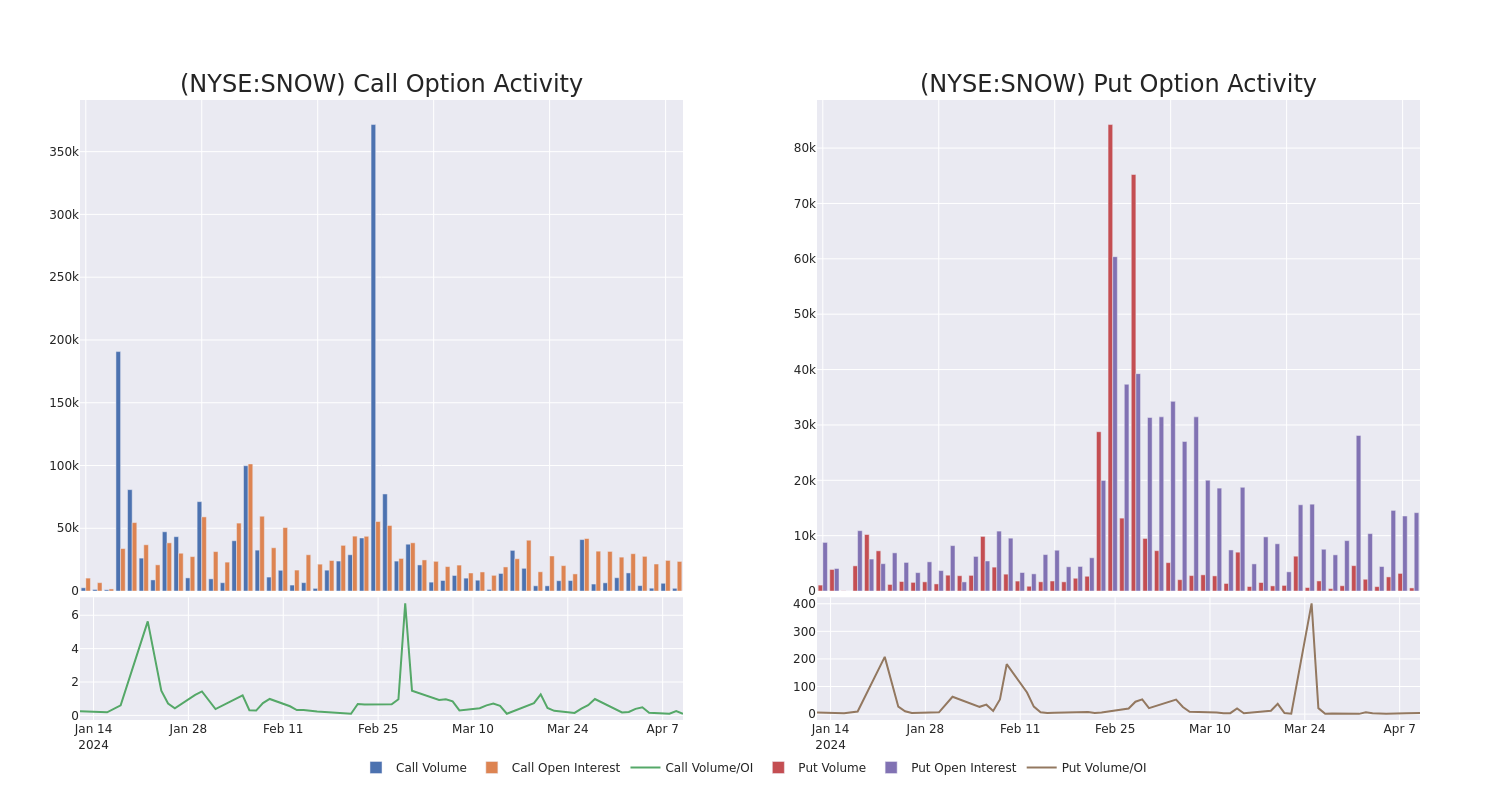

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in …

Full story available on Benzinga.com

Whales with a lot of money to spend have taken a noticeably bullish stance on Snowflake.

Looking at options history for Snowflake (NYSE:SNOW) we detected 46 trades.

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 23 are puts, for a total amount of $1,451,282 and 23, calls, for a total amount of $965,956.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $250.0 for Snowflake over the last 3 months.

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in …

Full story available on Benzinga.com

Whales with a lot of money to spend have taken a noticeably bullish stance on Snowflake.

Looking at options history for Snowflake (NYSE:SNOW) we detected 46 trades.

If we consider the specifics of each trade, it is accurate to state that 58% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 23 are puts, for a total amount of $1,451,282 and 23, calls, for a total amount of $965,956.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $250.0 for Snowflake over the last 3 months.

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in …Full story available on Benzinga.com Read MoreBZI-UOA, SNOW, Options, Markets, SNOW, Options, Markets, Benzinga Markets